用C语言和JS分别实现“个税年度汇算清缴”计算

时间:09-07来源:作者:点击数:

2019年4月开始实行个税改革,每年3-6月进行一次汇算清缴。个人所得税app上汇算清缴的计算你能看明白吗?既然大家都是程序员,那么自己用代码计算一遍吧!

C语言版本:

int main(int argc,char **argv)

{

float sum=300000,dec0=60000,dec1=15646.87,dec2=12000;

float dec=dec0+dec1+dec2;

printf("税前收入:%f\n",sum);

printf("通用减除:%f\n",dec0);

printf("专项扣除: %f\n",dec1);

printf("专项附加扣除:%f\n",dec2);

printf("总扣除=通用减除+专项扣除+专项附加扣除= %f\n",dec);

float sumReal=sum-dec;

printf("实际应缴总额=税前收入-总扣除= %f\n",sumReal);

float tax=0.0f,taxRate=0.0f,dec3=0.0f;

if(sumReal<=36000){

printf("适用税率: 3%%");

taxRate=0.03;

dec3=0.0f;

}

else if(36000<sumReal&&sumReal<=144000){

printf("适用税率:10%%");

taxRate=0.1;

dec3=2520.0f;

}

else if(144000<sumReal&&sumReal<=300000){

printf("适用税率:20%%\n");

taxRate=0.2;

dec3=16920.0f;

}

else if(300000<sumReal&&sumReal<=420000){

printf("适用税率:25%%\n");

taxRate=0.25;

dec3=31920.0f;

}

else if(420000<sumReal&&sumReal<=660000){

printf("适用税率:30%%\n");

taxRate=0.3;

dec3=52920.0f;

}

else if(660000<sumReal&&sumReal<=960000){

printf("适用税率:35%%\n");

taxRate=0.35;

dec3=85920.0f;

}

else if(960000<sumReal){

printf("适用税率:45%%\n");

taxRate=0.45;

dec3=181920.0f;

}

tax=sumReal*taxRate-dec3;

printf("应缴税额=%f*%f-%f= %f\n",sumReal,taxRate,dec3,tax);

return 0;

}

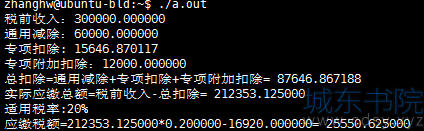

运行结果:

C语言的版本需要gcc或VS编译,嫌麻烦的话,还有JS版本,有浏览器就行。

JS版本:

<!DOCTYPE html>

<html>

<head>

<meta charset="utf-8">

<title>个税年度汇缴计算</title>

<script>

function cactax(idresult,idsum,iddec0,iddec1,iddec2){

var sum=parseFloat(document.getElementById(idsum).value);

var dec0=parseFloat(document.getElementById(iddec0).value);

var dec1=parseFloat(document.getElementById(iddec1).value);

var dec2=parseFloat(document.getElementById(iddec2).value);

var srtstr="";

var dec=dec0+dec1+dec2;

srtstr=srtstr+("税前收入:")+sum.toString()+"<br>";

srtstr=srtstr+("通用减除:")+dec0.toString()+"<br>";

srtstr=srtstr+("专项扣除: ")+dec1.toString()+"<br>";

srtstr=srtstr+("专项附加扣除:\n")+dec2.toString()+"<br>";

srtstr=srtstr+("总扣除=通用减除+专项扣除+专项附加扣除= ")+dec.toString()+"<br>";

var sumReal=sum-dec;

srtstr=srtstr+("实际应缴总额=税前收入-总扣除= \n")+sumReal.toString()+"<br>";

var tax=0.0,taxRate=0.0,dec3=0.0;

if(sumReal<=36000){

srtstr=srtstr+("适用税率: 3%")+"<br>";

taxRate=0.03;

dec3=0.0;

}

else if(36000<sumReal&&sumReal<=144000){

srtstr=srtstr+("适用税率:10%")+"<br>";

taxRate=0.1;

dec3=2520.0;

}

else if(144000<sumReal&&sumReal<=300000){

srtstr=srtstr+("适用税率:20%")+"<br>";

taxRate=0.2;

dec3=16920.0;

}

else if(300000<sumReal&&sumReal<=420000){

srtstr=srtstr+("适用税率:25%")+"<br>";

taxRate=0.25;

dec3=31920.0;

}

else if(420000<sumReal&&sumReal<=660000){

srtstr=srtstr+("适用税率:30%")+"<br>";

taxRate=0.3;

dec3=52920.0;

}

else if(660000<sumReal&&sumReal<=960000){

srtstr=srtstr+("适用税率:35%")+"<br>";

taxRate=0.35;

dec3=85920.0;

}

else if(960000<sumReal){

srtstr=srtstr+("适用税率:45%")+"<br>";

taxRate=0.45;

dec3=181920.0;

}

tax=sumReal*taxRate-dec3;

srtstr=srtstr+("应缴税额=")+sumReal.toString()+"*"+taxRate.toString()+("-")+dec3.toString()+"="+tax.toString();+"<br>";

document.getElementById(idresult).innerHTML=srtstr;

}

</script>

</head>

<body>

<div>

<p>税前收入:<input id="sum" type="text" style="width:1000px;;" value=""></p>

<p>通用减除:<input id="dec0" type="text" style="width:1000px;;" value="60000"></p>

<p>专项扣除:<input id="dec1" type="text" style="width:1000px;;" value=""></p>

<p>专项附加扣除:<input id="dec2" type="text" style="width:1000px;;" value=""></p>

<p>计算结果:</p>

<p id="result"></p>

<input type="submit" onclick="cactax('result','sum','dec0','dec1','dec2')" value="计算">

</div>

</body>

</html>

保存为《个税年度清缴汇算.html》,然后双击打开即可计算:

方便获取更多学习、工作、生活信息请关注本站微信公众号

上一篇:常见的数据结构及应用

下一篇:点、线、弧相关算法

推荐内容

相关内容

栏目更新

栏目热门

本栏推荐

湘公网安备 43102202000103号

湘公网安备 43102202000103号